Is The Texas Tuition Promise Fund for You?

The Texas Tuition Promise Fund (Plan) offers many advantages:

- Benefits are tax free when used to pay tuition and Required Fees: Required fees are only those that must be paid by all students as a condition of enrollment in the college or university. They do not include course-specific fees such as equipment usage or lab fees, or fees related to your major or year of study.

- Today’s prices pay for tomorrow’s education at most Texas public colleges and universities (excluding medical and dental schools, health science centers and other health-related institutions).

- Flexible options for every budget

- Benefits are transferrable to another eligible Beneficiary

- Tuition is locked in – but you’re not

Earnings are Tax Free

Any earnings on your contributions are Federal Tax Free: Any earnings on prepaid tuition contracts are federal tax free if used to pay eligible tuition and required fees. Refunds of earnings on contract payments are subject to federal income taxes and may be subject to an additional 10% federal tax penalty. See Plan Description and Master Agreement for details. if you use the Plan to pay for your Beneficiary’s tuition and Required Fees: Required fees are only those that must be paid by all students as a condition of enrollment in the college or university. They do not include course-specific fees such as equipment usage or lab fees, or fees related to your major or year of study. .

You Can Get More Out of Your Money

The Texas Higher Education Coordinating Board reports that tuition costs in Texas on average rose 87%: The Texas Higher Education Coordinating Board reports that from fall 2003 through fall 2020, the statewide average total academic charges for a student taking 15 semester credit hours at a public university has increased 163 percent (87 percent when adjusted for inflation). – Overview: Tuition Deregulation and Tuition Set Asides, March 2021 from 2003-2020. Buy Tuition Units: Tuition Units are the unit of measure used to purchase prepaid tuition. Generally, one unit represents one percent of the cost of tuition and required fees for 30 semester hours at the school that most closely matches the unit’s pricing structure. now at today’s prices that can be redeemed at mot two- and four-year Texas public colleges and universities (excluding medical and dental schools, health science centers and other health-related institutions) when your Beneficiary is ready for college and don’t worry about future tuition increases.

Flexible Options and Payment Plans for any Budget

Choose from three types of Tuition Units: Tuition Units are the unit of measure used to purchase prepaid tuition. Generally, one unit represents one percent of the cost of tuition and required fees for 30 semester hours at the school that most closely matches the unit’s pricing structure. , starting at around $25, and multiple payment plans that fit your goals AND your pocketbook.

Tuition Is Locked In – But You’re Not

If your Beneficiary doesn’t go to college or need all the units, you have several options:

- Do a Rollover of the Transfer Value: Transfer value is limited to the lesser of: 1) the costs the unit would cover at a Texas public college; or, 2) the price paid for the unit, plus or minus the Plan’s net investment earnings or losses on that amount. Transfer value does not include any state-provided or procured matching contributions or earnings thereon. to a 529 college savings plan so that the money can be used for graduate school, books or room and board, registered apprenticeship programs, K-12 tuition and student loan repayments. See IRS Publication 970 for certain limits that apply. Recent tax reform legislation changes allowing for payment of K-12 tuition were on a federal level, and the tax consequences of using 529 plans for elementary or secondary education tuition expenses will vary depending on state law and may include recapture of tax deductions received from the original state as well as penalties. The account owner should consult with a tax or legal advisor before using the plan for K-12 tuition.

- Change the Beneficiary of the contract to a current

member of the family:

As defined by IRS Publication 970, the Beneficiary's family includes the Beneficiary's spouse and any of the following other relatives of the Beneficiary:

1. Son, daughter, stepchild, foster child, adopted child, or a descendent of any of them. 2. Brother, sister, stepbrother, or stepsister.

3. Father or mother or ancestor of either.

4. Stepfather or stepmother.

5. Son or daughter of a brother or sister.

6. Brother or sister of father or mother.

7. Son-in-law, daughter-in-law, father-in-law, mother-in-law, brother-in-law, or sister-in-law.

8. The spouse of any individual listed above.

9. First cousin.

The new Beneficiary must be a Texas resident or the child of a parent who is both the Purchaser and a Texas Resident. , that is either a Texas resident or the child of a parent who is both the Purchaser and a Texas resident on the date of the change. - Request a refund and withdraw the Refund Value of unused Tuition Units: Tuition Units are the unit of measure used to purchase prepaid tuition. Generally, one unit represents one percent of the cost of tuition and required fees for 30 semester hours at the school that most closely matches the unit’s pricing structure. that have met the three-year holding period requirement or the Reduced Refund Value for units held less than three years. The earnings portion of a Refund, if any, is subject to the actuarial soundness of the Plan and is subject to federal income taxes plus a 10% federal tax as well as any state or local taxes that may apply. Refund Value does not include any state-provided or procured matching contributions or earnings thereon.

If your Beneficiary attends a medical or dental institution, private or out-of-state college or university, career school or registered apprenticeship program where tuition and fees are not locked in, you can apply the Transfer Value: Transfer value is limited to the lesser of: 1) the costs the unit would cover at a Texas public college; or, 2) the price paid for the unit, plus or minus the Plan’s net investment earnings or losses on that amount. Transfer value does not include any state-provided or procured matching contributions or earnings thereon. towards the cost of tuition and schoolwide Required Fees: Required fees are only those that must be paid by all students as a condition of enrollment in the college or university. They do not include course-specific fees such as equipment usage or lab fees, or fees related to your major or year of study. .

Start Today

If tuition inflation continues, the earlier you start, the less expensive it will be to purchase a Plan and lock in tuition and Required Fees: Required fees are only those that must be paid by all students as a condition of enrollment in the college or university. They do not include course-specific fees such as equipment usage or lab fees, or fees related to your major or year of study. at today’s prices at Texas public colleges and universities.

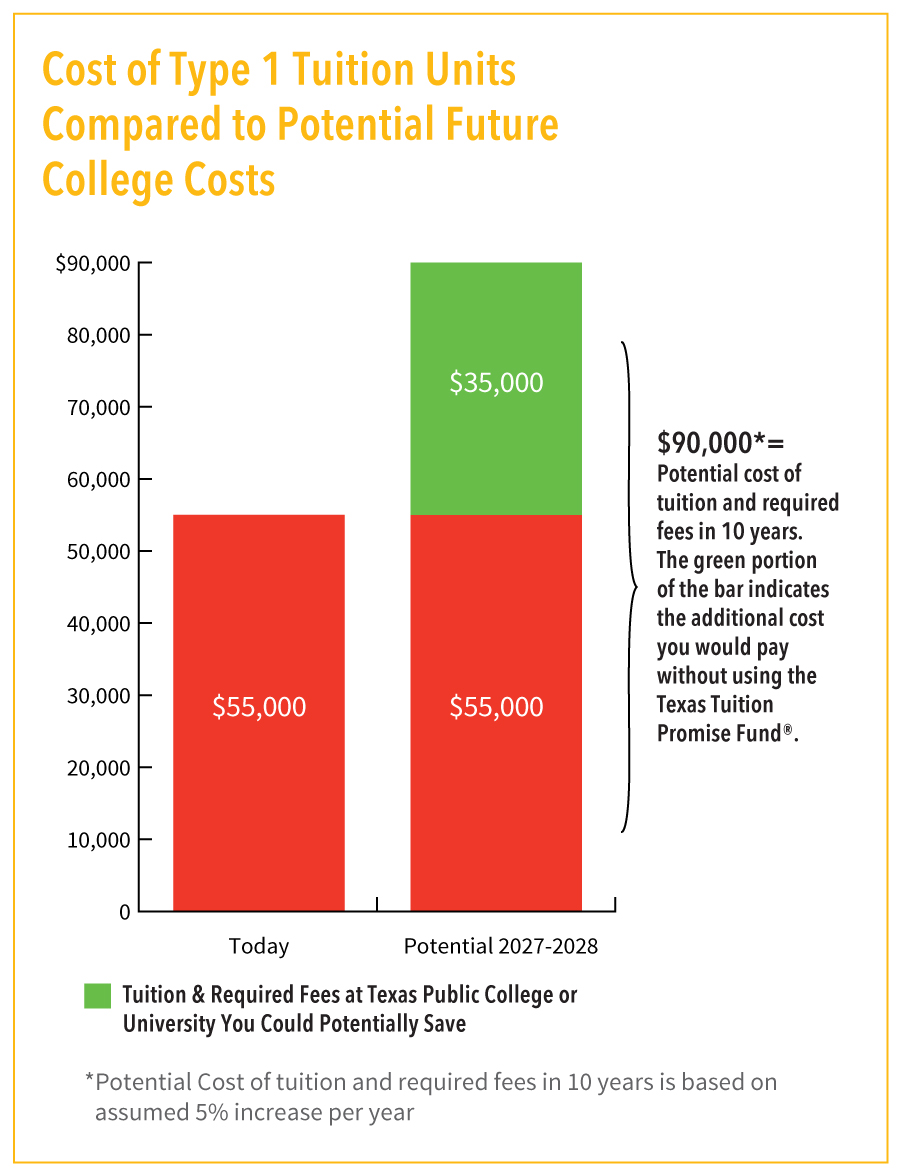

Cost of Type I Tuition Units: Tuition Units are the unit of measure used to purchase prepaid tuition. Generally, one unit represents one percent of the cost of tuition and required fees for 30 semester hours at the school that most closely matches the unit’s pricing structure. Compared to Potential Future College Costs For One Year of Tuition

This graph shows that tuition and fees today totaling a hypothetical $55,000 could increase to $90,000 in 10 years, assuming a 5% increase in tuition and fees per year. Using the Texas Tuition Promise Fund, you could save $35,000 in this hypothetical situation, and keep the overall cost to you at $55,000.

This graph shows that tuition and fees today totaling a hypothetical $55,000 could increase to $90,000 in 10 years, assuming a 5% increase in tuition and fees per year. Using the Texas Tuition Promise Fund, you could save $35,000 in this hypothetical situation, and keep the overall cost to you at $55,000.

For Illustrative Purposes Only

5687-NLD-09/28/2017Compliance Code: 5 6 8 7, NLD, September, 28, 2017