What is a Prepaid Plan?

There are various ways to fund a college education – savings, loans, financial aid and scholarships.

Section 529 of the Internal Revenue Code authorizes states to establish programs that allow Purchaser: The person who establishes the Contract for a specified Beneficiary. There can only be one Purchaser for each Contract. The Purchaser is responsible for making payments in a timely manner and is the only person who may direct or receive refunds, or may direct rollovers, Contract changes, and changes in the designated Beneficiary except that the Contract may be cancelled or modified by the Plan. Friends and family who contribute to another person’s account are not the Purchaser and may not prevent, direct or receive refunds, and may not direct rollovers, contract changes, or changes in the designated Beneficiary. to prepay a student’s qualified education expenses at a postsecondary institution. When it comes to saving for college, due to their tax advantages, state-sponsored 529 Plan: A 529 plan is an education savings plan operated by a state or an educational institution and designed to help families set aside funds for college. It is named after Section 529 of the internal revenue code, which authorized these types of tax-advantaged savings plans in 1996. Earnings on 529 plans are tax-free if used for qualified higher education expenses. (Unqualified withdrawals may be taxable as ordinary income and subject to a 10% federal tax penalty.) The Pension Protection Act of 2006 made the tax-free character of 529s a permanent part of federal law. are a popular choice. Learn more about saving for college in Texas.

Also known as Qualified Tuition Programs (QTPs) or Prepaid Education Arrangements (PEAs), 529 Prepaid Tuition Plans: Also known as Qualified Tuition Programs (QTPs) or Prepaid Education Arrangements (PEAs), 529 prepaid tuition plans allow families to buy all or part of a public in-state education at present-day prices. allow families to buy all or part of a public in-state education at present-day prices.

Features of the Texas Tuition Promise Fund Prepaid Plan

- Purchasers can prepay undergraduate resident tuition and Required Fees: Required fees are only those that must be paid by all students as a condition of enrollment in the college or university. They do not include course-specific fees such as equipment usage or lab fees, or fees related to your major or year of study. at most Texas public colleges and universities (excluding medical and dental schools, health science centers and other health-related institutions) at today’s prices rather than at prices in effect when the Beneficiary enrolls.

- The Plan is administered by the state of Texas.

- Purchasers and beneficiaries must meet Texas Residency: Residency means domicile within the State of Texas at the time the Purchaser enters into a Contract. requirements.

- Any earnings on qualified withdrawals are tax-free.

In general, the Texas Tuition Promise Fund is a way to lock in the price of tuition and Required Fees: Required fees are only those that must be paid by all students as a condition of enrollment in the college or university. They do not include course-specific fees such as equipment usage or lab fees, or fees related to your major or year of study. at today’s prices at most Texas public colleges and universities (excluding medical and dental schools, health science centers and other health-related institutions), thus insuring against college cost inflation, which is helpful considering college costs have been rising two to three times the rate of inflation.

In contrast, a savings plan is best thought of as a tax-advantaged way to build up a college fund. Savings plans do not lock in the cost of covered educational expenses. However, you can use your savings plan for more kinds of higher education expenses.

On the Road to Higher Education

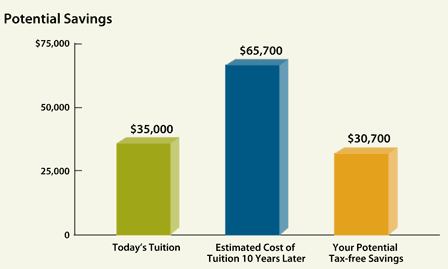

This hypothetical cost comparison illustrates the potential savings that could be realized by prepaying and “locking in” a tuition price at $35,000 for a four-year Texas public college versus waiting 10 years and, assuming a cost increase of 6.5% a year, paying $65,700.